NEW EUROPEAN CERTIFICATE OF SUCCESSION FOR A SPANISH INHERITANCE

The European Certificate of Succession is a ´new´ standard for international inheritance procedures within the European Union (EU regulation number 650/2012 of the European Parliament). It is applicable to successions of persons who die with assets in different countries of the European Union from 17 August 2015. The European Certificate of Succession is a public document of a voluntary nature, which contains the essential information about inheritance, such as the details of the deceased, information about the last will, applicable inheritance law, details of the heirs and the assets allocated to each legal heir.

In certain cases the certificate can save the heirs costs because they f.e. can avoid the Spanish inheritance deeds. However, the regulation of the European Certificate of Succession does not apply to citizens of the United Kingdom (due to Brexit) and neither to Ireland and Denmark.

Increasement in international inheritances in Andalusia, Spain

This European Regulation is very important in some parts of Spain, such as Andalusia, Malaga and in particular in the Costa del Sol. The reason for this is that here are many foreign owners of assets and homes, both resident and non-resident in Spain. They normally bequeath their assets to their spouse or children through a will (testament), who usually live in the country of their nationality, such as the Netherlands, Belgium, Germany, England, Sweden, etc.

Unfortunately, with the coronavirus pandemic, many hereditary procedures are being highlighted in Spain, due to the unfortunate number of death, which has led to more succession procedures taking place than usual. This also results in longer waiting times at the central last will registry in Madrid (Registro de Ultimos Voluntades).

What is the main purpose of the European Certificate of Succession?

This certificate is an official document that allows for accrediting, in any country in the European Union, all the information about an inheritance distribution. This must be in accordance with the national law of the member state and is meant to make the international process easier and cheaper.

Who can request and who may issue this certificate?

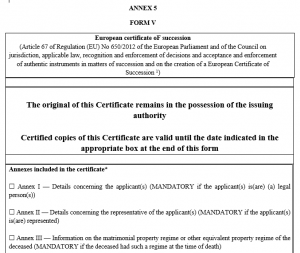

The heirs, legatees having rights in the succession and executors of wills or administrators of the estate may request the issue of a European Certificate of Succession. This needs to happen by submitting form IV, included in annex 4 of Regulation (EU) no. 1329/2014, of 9 December, of the Commission.

This certificate by law may be issued by the court or notary of the country of which the inheritance law applies. This is either the country of residency or the country of which the law has been chosen in the Last Will.

More information and a link to the template of the fill-out form you can find on the website of the European Union.

Which inheritance cases is it intended for?

This new international standard is intended for succession processes of European Union citizens, whose heirs have distributed the inheritance in their country of nationality, with the testator owning property in Spain or another country in the European Union. As said before, this regulation of the European Certificate of Succession does not apply to citizens of the United Kingdom, Ireland and Denmark.

For example: Let’s imagine that there are Belgian heirs, whose father signed a last will. In this Belgian or Spanish will or testament he chose the law of his nationality to apply and the heirs distribute their father’s estate in the city of Ghent. The deceased had purchased a home in Malaga and also had money in a Spanish bank. They can directly request a European Certificate of Succession from this Belgian notary, in order to submit it in Spain. This to be able to inscribe the assets owned by their father in Malaga according to the applicable rules in name of the legal heirs.

What are the benefits of this European Certificate of Succession?

The main advantage of this certificate is that it´s a standard document in English valid in every European country. This makes the inheritance process in Spain or other countries easier and avoids certain costs.

Firstly, the European Certificate of law doesn´t require (possible multiple) legal translations anymore, nor the international ´Apostille of The Hague´. (The Apostille or Apostle of The Hague is a small certificate from the court to proof to the foreign notary that it is an official notorial document). This doesn´t only save costs but also a good amount of time. The legal translation and Apostille until now were always needed for the national Declaration of Law that of course still exists.

Secondly, the European Certificate of Succession in certain, simple cases can be directly used to distribute the assets owned by the deceased. In these specific cases the considerable cost for the Spanish inheritance deeds can be spared.

What are the drawbacks?

One of the main drawbacks is that the certificate is only valid for six months from its date of issue. However, it is possible to request an extension.

Also, as said before, the certificate is not automatically valid for heirs to register the property purchased by their father, which they have inherited. This needs to be done in the Spanish Land Registry (Registro de la Propiedad) and this authority depending on the exact situation can still require the Spanish Inheritance Deeds of the notary. This is explained in more detail at the end of the article.

In any case it´s important that the heirs sign a wide notarial Power of Attorney to their Spanish lawyer. This always needs to include a clause for the potential signing of the Inheritance Deeds, in case still needed after all. Also the normal procedures as the tax declaration or representation before the bank need to be included.

Does this certificate have any impact on Inheritance Tax?

There is no impact on Inheritance Tax or on the declaration procedure of this tax. Once the European Certificate of Succession is received in Spain, the tax form to pay the corresponding Inheritance Tax must be submitted to the Spanish tax office. This even if the payable amount is cero like in most cases in Andalusia for close family members as spouses, children, parents and grandchildren. The tax declaration needs to be done before being able to take the paperwork to the banking institution or the Land Registry, the Oficina de Liquidadora.

The height of inheritance tax depends on the:

- relation to the deceased

- (fiscal) value of the assets inherited in Spain

- balance of the bank account(s) on the moment of death

- official worth of a vehicle

It is important to know that inheritance tax must be declared within six months following the date of death. Likewise, if an urban property is inherited Plusvalia tax must be paid. The Plusvalia is local profit tax counted by years of ownership of a property.

Effects on the Land Registry record in Spain

As said, the Land Registry in Spain in certain cases does directly admit the European Certificate of Succession as a title of the hereditary succession. This exemption to register a property in the name of legal heir without the need for a notary inheritance deed or judgment is only possible in the following situation. Also, the Land Registry at all times preserves the right to require Spanish inheritance deeds or other additional legal documentation after all.

Requirements for (potentially) avoiding Spanish inheritance deeds:

- Only one single heir

- No interested parties, with the right to a reserved share (like or example children under Dutch or Belgian inheritance law)

- No curator or authorized person to conduct the inheritance process

Required documentation for the Land Registry when inheritances deeds are not required:

- International Death Certificate

- Last will or testament (if not signed in Spain, then with legal translation and Apostille)

- Certificate of the Spanish Last Will registry (Registro de Ultimos Voluntades)

- Notary document signed by the sole heir explicitly requesting the inscription of the property in their name in the Land Registry. This document can be signed by the notary in their own country (in this case the legal translation and Apostille of The Hague are required). However, it can also be done by a Spanish notary.

Conclusion: legal advice for your Spanish inheritance process

The Spanish inheritance process unfortunately is complex, costly and surrounded by lots of bureaucracy, as you surely understand from this article. Are you involved in an inheritance process where the deceased owns a property in Andalusia? And are you in need of legal advice to save time and costs? Do not hesitate to contact C&D Solicitors and our lawyers will be happy to guide you. We are a law firm specializing in providing legal and tax advice to foreigners in Andalusia and we know how to help to make this process as easy as possible for heirs. You can contact us so we can provide the first free consultation or offer.

More information: You can read more about inheritance law and Spanish wills under ´legal services´ where you can also watch our video of the overall process.

Author: Gustavo Calero Monereo, lawyer at C&D Solicitors, Málaga (Andalusia)